It is without a doubt that our industry is evolving both by consumer expectations and sophistication, as well as regulatory and legislative amendments.

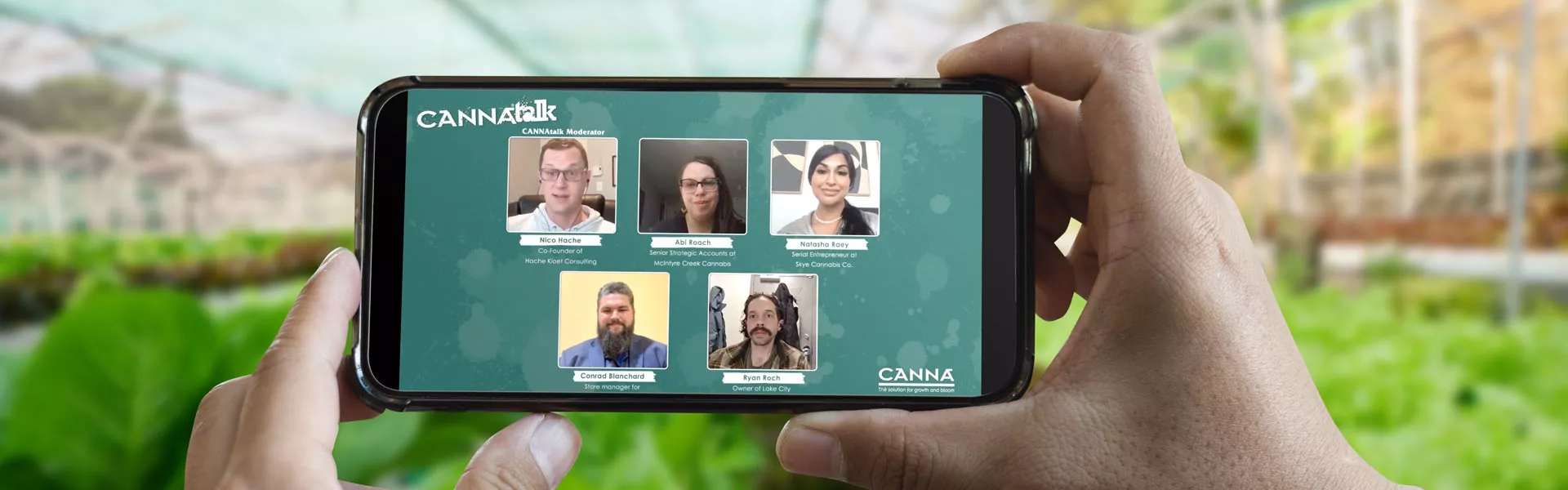

In this segment of CANNAtalk, we took an in depth look at “what’s hot and what’s not” on the retail shelf with a focus on what product categories and formulations producers should focus on to stay ahead and maintain a competitive edge!

The panel discussion provided valuable insights into the evolving cannabis industry in Canada, highlighting key considerations for producers aiming to meet consumer demands and position their products effectively in the market. Here's a breakdown of the key points discussed:

- Understanding Market Segments: Producers need to understand the different market segments and align their products accordingly. This involves categorizing products correctly and avoiding mismatches, such as placing B grade flower in the premium flower category.

- Consumer Trends and Demands: Consumer preferences vary across demographics, emphasizing the importance of staying close to consumers to supply what is needed. Flexibility in tailoring shelf space for local demand can be advantageous, but it poses challenges in provinces with provincial distribution systems.

- Beyond THC: Consumers are becoming more knowledgeable, and THC is no longer the sole quality attribute they seek. Attributes such as terpenes and other cannabinoids are now part of the equation, leading to the emergence of lower THC products deemed premium.

- Standardized Testing: The move towards standardized testing, exemplified by the OCS' decision to use one laboratory as a standard, impacts sampling, ethics, and producer practices. This shift will not only influence how laboratories perform testing but also how producers take and send samples for testing.

- Competition in 2.0 Products: The proliferation of 2.0 products has increased competition and led to a price drop at retail. However, the oversupply of extraction material, which drove this trend, is diminishing. This could potentially stabilize prices for concentrates and extracts.

- Engaging with Retailers: Producers should maintain close communication with retailers to stay informed about market trends and consumer preferences. Spending time with retailers provides valuable market data that can help producers meet consumer demands effectively.

- Education and Consumer Outreach: Education is essential for reaching consumers and fostering understanding about cannabis products. Many provinces have programs for supplier education, which can contribute to social and educational development.

In summary, producers can better align their products in the market and keep up with trends by engaging closely with retailers, staying informed about consumer preferences, considering factors beyond THC content, and investing in education and outreach initiatives!

Save the date and join in for our next online session on Thursday, April 25th via www.canna.ca/cannatalkonline